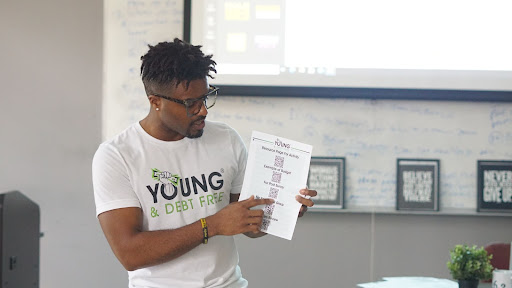

High School Financial Literacy Group Workshops

Workshop #1: Money Psychology and The Cost of Living

Students Will Be Able To:

-

- Identify ways behavioral psychology affects spending Identify ways upbringing, environment, and society play a role in their spending habits

- Explore the common myths about money and learn about specific spender and consumer behavior

- List Money Affirmations and Correlate Inner core values with money

- Define Income, gross income and net income

- Calculate realistic housing cost in U.S Cities

High School, 90 Mins.

With MJ Bridges

Workshop #2: Savings And Budgeting

Students Will Be Able To:

- Explore various systems of saving money

- Create An Expense Tracking System

- Determine Monthly Expenses Identify Needs and Wants Increase Income Through Savings

- Separate and Label Expenses By Category Create a Budget for Today and Tomorrow

High School, 90 Mins.

With MJ Bridges

Workshop # 3 Managing Debt And Credit Basics

Students Will Be Able To:

- Identify The 3 Credit Bureaus

- Locate Credit Scores

- Apply Methods to Building a 750+ Credit Score

- Understand how personal credit correlates to business credit

- Calculate Annual Percentage Rates

- Identify Statement Dates vs Due Dates on Credit Card Bills

- Create An Expense Tracking System

High School, 90 Mins.

With MJ Bridges

ALL WORKSHOPS INCLUDE:

- Booklets / Guided Notes

- Activities

- Spiral Bound 70 Page Workbooks

- Up to 3 hours

- Prizes and more

High School Workbook

The Money Back Challenge: 21 Lessons For Building A Healthy Foundation of Budgeting, Savings, and Credit.

College Financial Literacy Group Workshops

Workshop # 1: Personal Budgeting

Students Will Be Able To:

- Explore various systems of saving money

- Create An Expense Tracking System

- Determine Monthly Expenses Identify Needs and Wants Increase Income Through Savings

- Separate and Label Expenses By Category Create a Budget for Today and Tomorrow

College Students and Young Adults, 90 Mins.

With MJ Bridges

Workshop #2: Debt Elimination And Debt Management

Students Will Be Able To:

- Identify Annual Percentage rates and Interest on current debts

- Access information on repayment on federal student loans

- Manage Credit Card Debt

- Calculate payments to determine pay-off dates

- Identify various fees associated with credit cards

- Learn about various methods of managing debt such as credit card balance transfers

College Students and Young Adults, 90 Mins.

With MJ Bridges

Workshop # 3 Personal Credit

Students Will Be Able To:

- Identify The 3 Credit Bureaus

- Locate Credit Scores

- Apply Methods to Building a 750+ Credit Score

- Understand how personal credit correlates to business credit

- Calculate Annual Percentage Rates

- Identify Statement Dates vs Due Dates on Credit Card Bills

- Create An Expense Tracking System

College Students and Young Adults, 90 Mins.

With MJ Bridges

ALL WORKSHOPS INCLUDE:

- Booklets / Guided Notes

- Activities

- Spiral Bound 70 Page Workbooks

- Up to 2 hours

- Prizes and more

FREE COURSES

C.O.I.N.$ – The Steps I took to Eliminate $97,000 of Debt” (Debt Elimination)

Brought to you by Young & Debt Free.

Time: 37:54

With MJ Bridges

The Importance of Financial Planning (Retirement Planning)

Brought to you by Young & Debt Free.

Time: 1:05:52

With J. Lamar

Money Talk Tuesday: An Intro To Ownership

- An Airbnb & Tiny House Owner

- An eBay Store Owner

- A Chick-fil-A Owner

- A Haircare Owner

Brought to you by Young & Debt Free.

Time: 1:13:48

With Young & Debt Free