The choice between a Roth IRA and a Traditional IRA depends on your individual financial situation, goals, and tax considerations. Here are the key differences between Roth and Traditional IRAs:

Traditional IRA:

- Tax Deductibility:

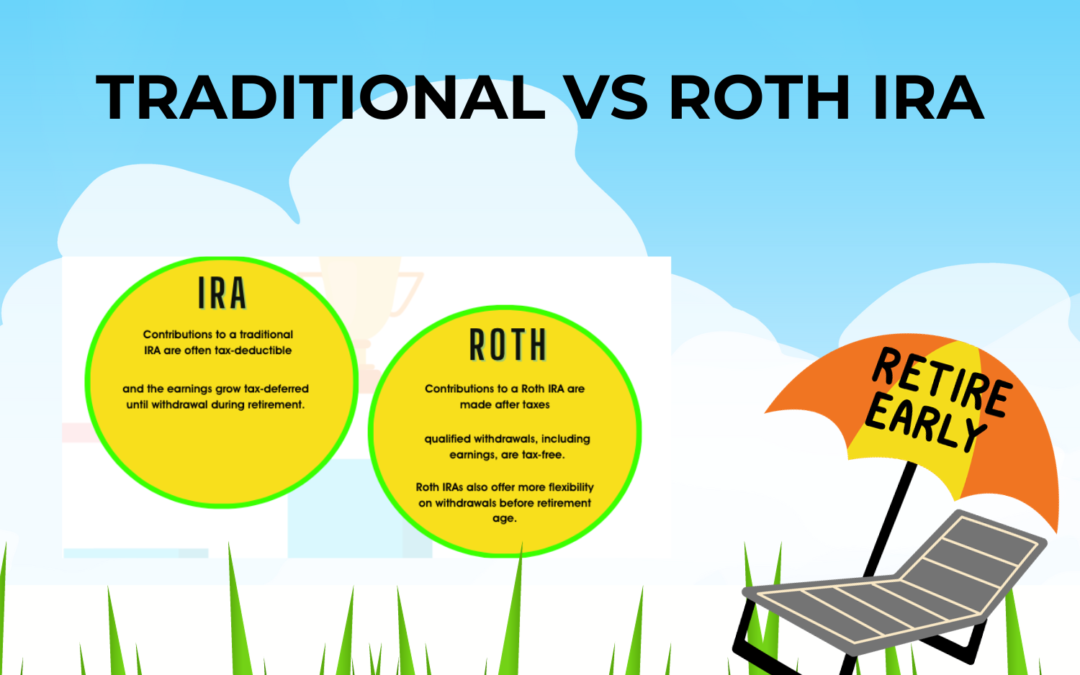

- Tax Deductible Contributions: Contributions to a Traditional IRA may be tax-deductible, providing an upfront tax benefit. However, the deductibility depends on factors such as your income, participation in an employer-sponsored retirement plan, and filing status.

- Tax-Deferred Growth:

- Tax-Deferred Earnings: Earnings on investments within a Traditional IRA grow tax-deferred until withdrawal. When you withdraw funds in retirement, the withdrawals are treated as ordinary income and taxed accordingly.

- Required Minimum Distributions (RMDs):

- RMDs: Starting at age 72, you must take Required Minimum Distributions (RMDs) from a Traditional IRA, which are mandatory withdrawals that are subject to taxation.

Roth IRA:

- Tax Treatment of Contributions:

- Non-Deductible Contributions: Contributions to a Roth IRA are not tax-deductible. You contribute to a Roth IRA with after-tax dollars.

- Tax-Free Growth:

- Tax-Free Earnings: Earnings on investments within a Roth IRA grow tax-free. Qualified withdrawals, including both contributions and earnings, are tax-free in retirement.

- No Required Minimum Distributions (RMDs):

- No RMDs: Roth IRAs do not have RMDs during the account holder’s lifetime. This flexibility can be beneficial for estate planning.

Factors to Consider:

- Current and Future Tax Situation:

- If you expect your tax rate to be higher in retirement, a Roth IRA may be advantageous. If you anticipate a lower tax rate in retirement, a Traditional IRA might provide more immediate tax benefits.

- Financial Goals:

- Consider your financial goals, time horizon, and investment preferences. Roth IRAs can be attractive for long-term growth and tax-free withdrawals, while Traditional IRAs may offer immediate tax benefits.

- RMDs and Estate Planning:

- If you want to avoid RMDs and plan for tax-efficient estate transfers, a Roth IRA might be a better fit.

- Income and Eligibility:

- Consider your income level and whether you meet the eligibility criteria for each type of IRA. Roth IRAs have income limits for contributions, while Traditional IRAs do not, but the deductibility of contributions may be limited based on income.

- Risk Tolerance:

- Roth IRAs may be more appealing to those with higher risk tolerance, as the contributions have already been taxed, and qualified withdrawals are tax-free.

Ultimately, there is no one-size-fits-all answer. It’s often beneficial to diversify your retirement savings across different account types. Consulting with a financial advisor or tax professional can help you make the decision that aligns with your specific circumstances and goals.