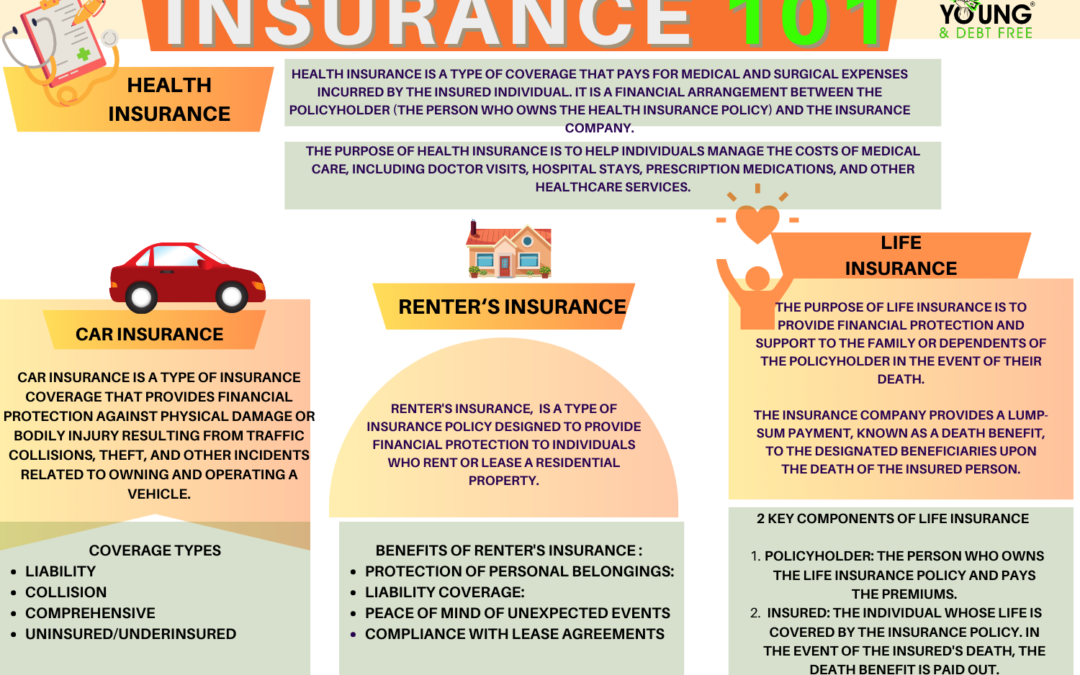

Renter’s insurance, also known as tenant’s insurance, is a type of insurance policy designed to provide financial protection to individuals who rent or lease a residential property. While the landlord’s insurance typically covers the building’s structure, renter’s insurance is focused on the personal belongings and liability of the tenant within the rented space.

Key components of renter’s insurance include:

- Personal Property Coverage:

- Protects the policyholder’s personal belongings, such as furniture, electronics, clothing, and other items, against covered perils. Covered perils often include events like fire, theft, vandalism, and certain natural disasters.

- Liability Coverage:

- Offers protection in case the policyholder is found legally responsible for causing injury to others or damaging their property. This coverage can help pay for legal fees, medical expenses, and property repair costs.

- Additional Living Expenses (ALE) Coverage:

- Covers additional living expenses if the rented property becomes uninhabitable due to a covered peril, and the policyholder needs to temporarily live elsewhere. This can include hotel costs, meals, and other related expenses.

- Medical Payments to Others:

- Provides coverage for medical expenses incurred by guests who are injured on the policyholder’s rented property, regardless of who is at fault.

It’s important to note that renter’s insurance does not cover the physical structure of the building itself, as that is the landlord’s responsibility. The renter’s insurance policy is focused on the tenant’s personal property and liability within the rented space.

Benefits of renter’s insurance include:

- Protection of Personal Belongings: In the event of covered perils like fire, theft, or vandalism, renter’s insurance helps replace or repair damaged or stolen items.

- Liability Coverage: Helps protect the policyholder from financial responsibility in case they are held liable for injuries to others or damage to their property.

- Peace of Mind: Renter’s insurance provides peace of mind by offering financial protection against unexpected events, reducing the financial burden on the tenant.

- Compliance with Lease Agreements: Some landlords may require tenants to have renter’s insurance as a condition of the lease agreement.

Before purchasing renter’s insurance, individuals should carefully review the policy terms, coverage limits, deductibles, and any additional options or endorsements available. It’s also advisable to create a comprehensive inventory of personal belongings to assist in the claims process in the event of a covered loss.