by bridgesm06@gmail.com | Jan 5, 2024 | Budgeting & Debt Payoff

The debt snowball method is a debt repayment strategy popularized by personal finance expert Dave Ramsey. It is a systematic approach to paying off multiple debts by focusing on clearing them one at a time, starting with the smallest balance first. The method is named...

by bridgesm06@gmail.com | Jan 5, 2024 | Credit, Student Loan Repayment Plans

Credit Score and History: Before applying for a credit card, it’s essential to know your credit score. A higher credit score increases your chances of approval for better credit cards with favorable terms. Reviewing your credit history can also help you...

by bridgesm06@gmail.com | Jan 5, 2024 | Credit, Student Loan Repayment Plans

A credit report is a detailed record of an individual’s credit history and financial behavior. The information in a credit report is compiled by credit reporting agencies, also known as credit bureaus. The components of a credit report typically include:...

by bridgesm06@gmail.com | Jan 5, 2024 | Credit, Student Loan Repayment Plans

The three major credit bureaus in the United States are: Equifax: Website: Equifax Phone: 1-866-349-5191 Experian: Website: Experian Phone: 1-888-397-3742 TransUnion: Website: TransUnion Phone: 1-800-916-8800 These credit reporting agencies collect and maintain...

by bridgesm06@gmail.com | Jan 4, 2024 | Credit, Student Loan Repayment Plans

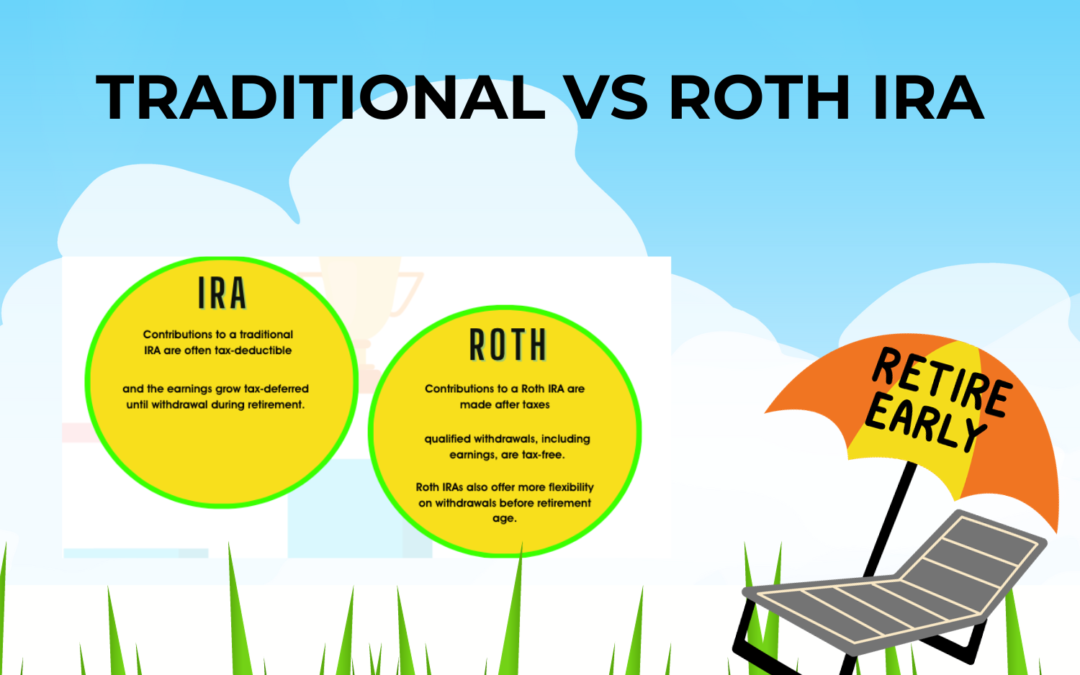

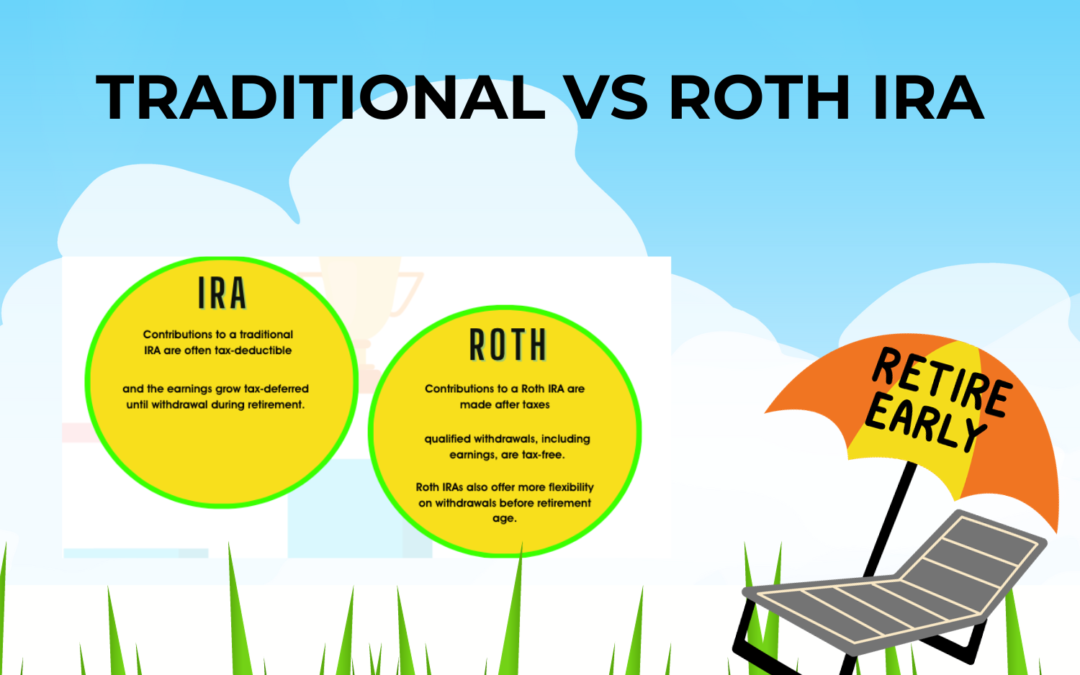

The choice between a Roth IRA and a Traditional IRA depends on your individual financial situation, goals, and tax considerations. Here are the key differences between Roth and Traditional IRAs: Traditional IRA: Tax Deductibility: Tax Deductible Contributions:...