MY BLOG

Insuranace(s) 101: The Basics of Health Insurance

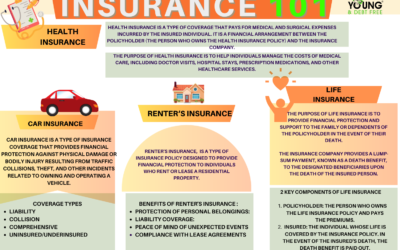

Health insurance is a type of coverage that pays for medical and surgical expenses incurred by the insured individual. It is a financial arrangement between the policyholder (the person who owns the health insurance policy) and the insurance company. The purpose of...

Insuranace(s) 101: The Basics of Life Insurance

Life insurance is a financial contract between an individual (the policyholder) and an insurance company. In exchange for regular premium payments, the insurance company provides a lump-sum payment, known as a death benefit, to the designated beneficiaries upon the...

14 Things To Consider When Looking For Your First Apartment

Finding your first apartment is an exciting but significant step. Here are some important considerations for young adults when searching for their first apartment: Budget: Determine a realistic budget that includes rent, utilities, groceries, transportation, and other...

Hourly Pay, Salary Pay And Take Home Pay

Hourly pay and salary pay are two different methods of compensating employees, and they have distinct characteristics: Hourly Pay: Definition: Hourly pay is a compensation structure where employees are paid a set rate for each hour of work they complete. Payment...

Gross and Net Income

Gross income and net income are two key financial metrics that individuals, businesses, and governments use to assess financial performance. Understanding the difference between these two concepts is crucial for various reasons: Clarity in Financial Health: Gross...

How To Avoid Common Banking Fees

Avoiding banking fees requires careful management of your accounts and understanding the terms and conditions set by your financial institution. Here are some strategies to help you avoid common banking fees: 1. Choose the Right Account: Select a checking or savings...