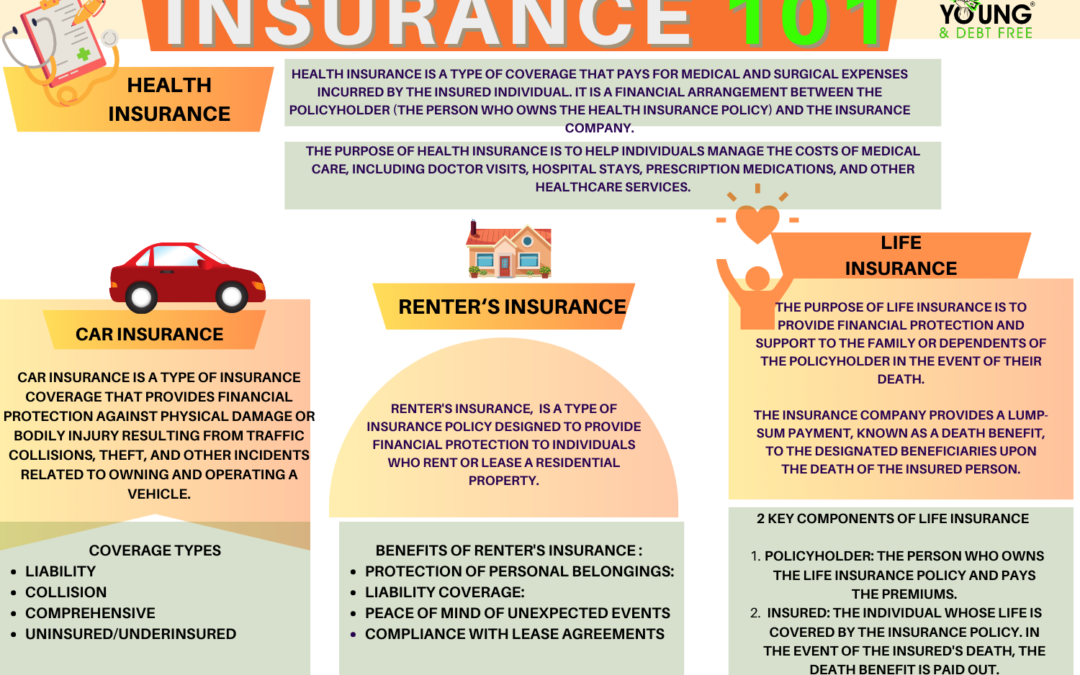

Health insurance is a type of coverage that pays for medical and surgical expenses incurred by the insured individual. It is a financial arrangement between the policyholder (the person who owns the health insurance policy) and the insurance company. The purpose of health insurance is to help individuals manage the costs of medical care, including doctor visits, hospital stays, prescription medications, and other healthcare services.

Key components of health insurance include:

- Policyholder: The person who owns the health insurance policy and is responsible for paying premiums to maintain coverage.

- Premium: The amount paid by the policyholder to the insurance company to maintain health insurance coverage. Premiums can be paid monthly, quarterly, or annually.

- Deductible: The initial amount that the insured individual must pay out of pocket for covered medical expenses before the insurance company starts to contribute. After reaching the deductible, the insurance plan typically covers a percentage of the remaining costs.

- Co-payment (Co-pay): A fixed amount paid by the insured at the time of receiving a specific medical service. For example, a doctor’s visit might have a set co-payment amount.

- Coinsurance: The percentage of covered medical expenses that the insured individual is required to pay after reaching the deductible. The insurance company covers the remaining percentage.

- Out-of-Pocket Maximum: The maximum amount that the insured individual is required to pay in a given policy period. Once this limit is reached, the insurance company covers 100% of covered expenses.

- Network: Health insurance plans often have a network of healthcare providers, including doctors, hospitals, and clinics. In-network providers typically offer lower costs for insured individuals.

- Coverage: Health insurance policies specify the types of medical services and treatments that are covered. This can include hospitalization, doctor visits, preventive care, prescription drugs, and more.

- Preventive Care: Many health insurance plans cover preventive services, such as vaccinations and screenings, without requiring the insured to meet a deductible or pay a co-payment.

Health insurance can be obtained through employers, government programs (such as Medicare and Medicaid in the United States), or purchased individually from private insurance companies. It is a crucial tool for managing healthcare costs, providing financial protection, and ensuring access to necessary medical services. The specific terms and coverage details of health insurance plans can vary, so it’s important for individuals to carefully review and understand their policy.