by bridgesm06@gmail.com | Jan 14, 2024 | Blog, Budgeting & Debt Payoff

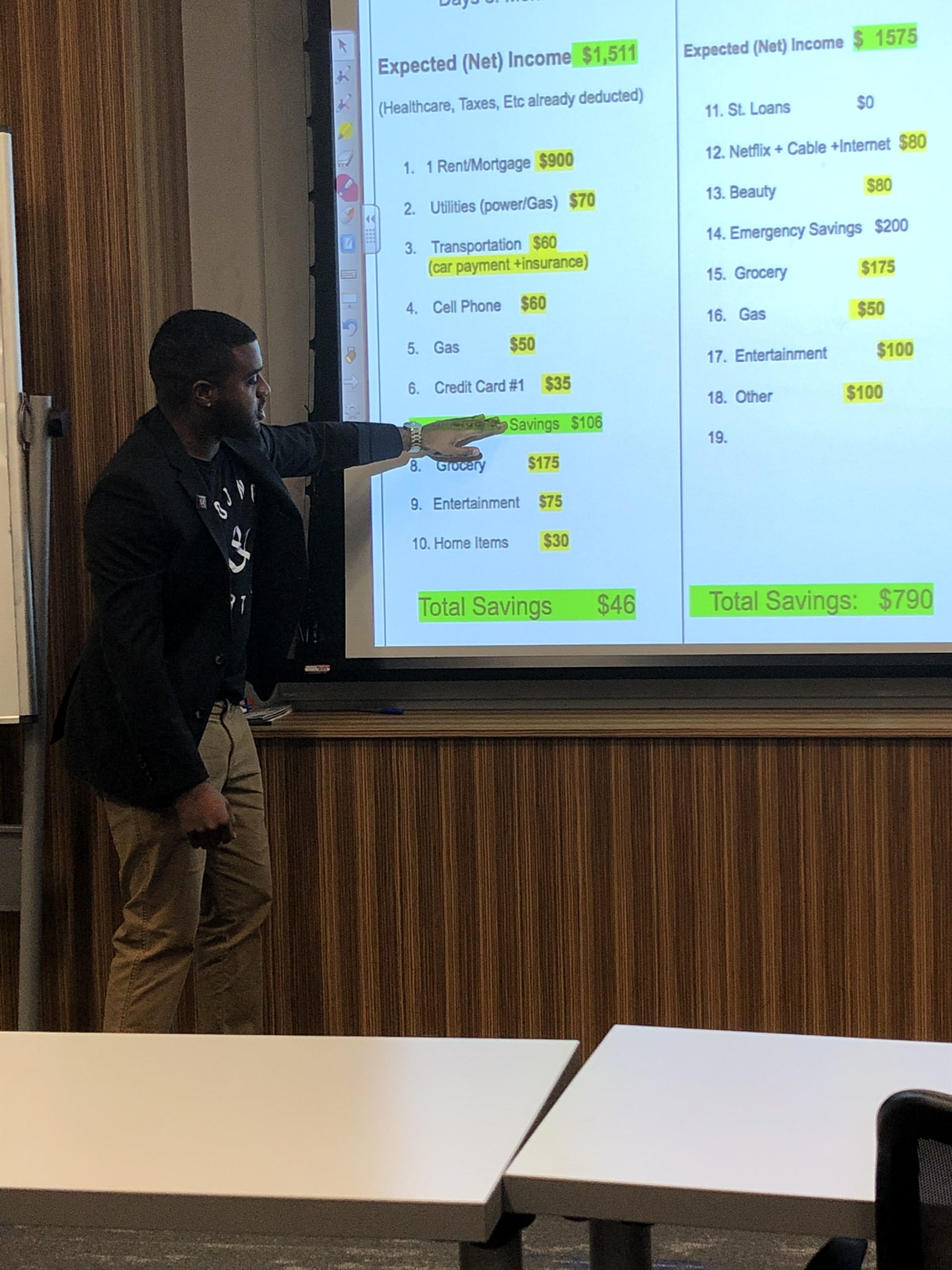

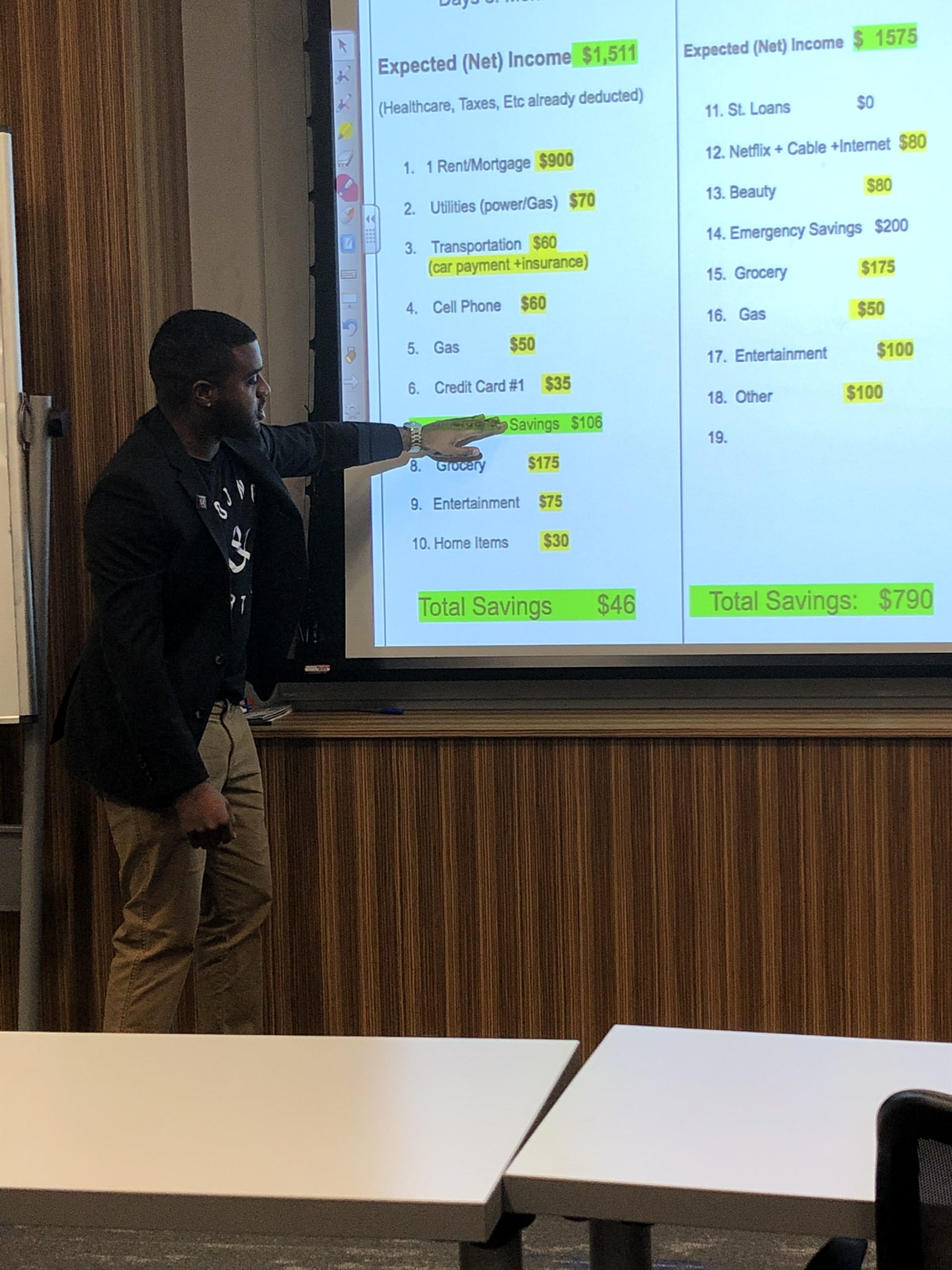

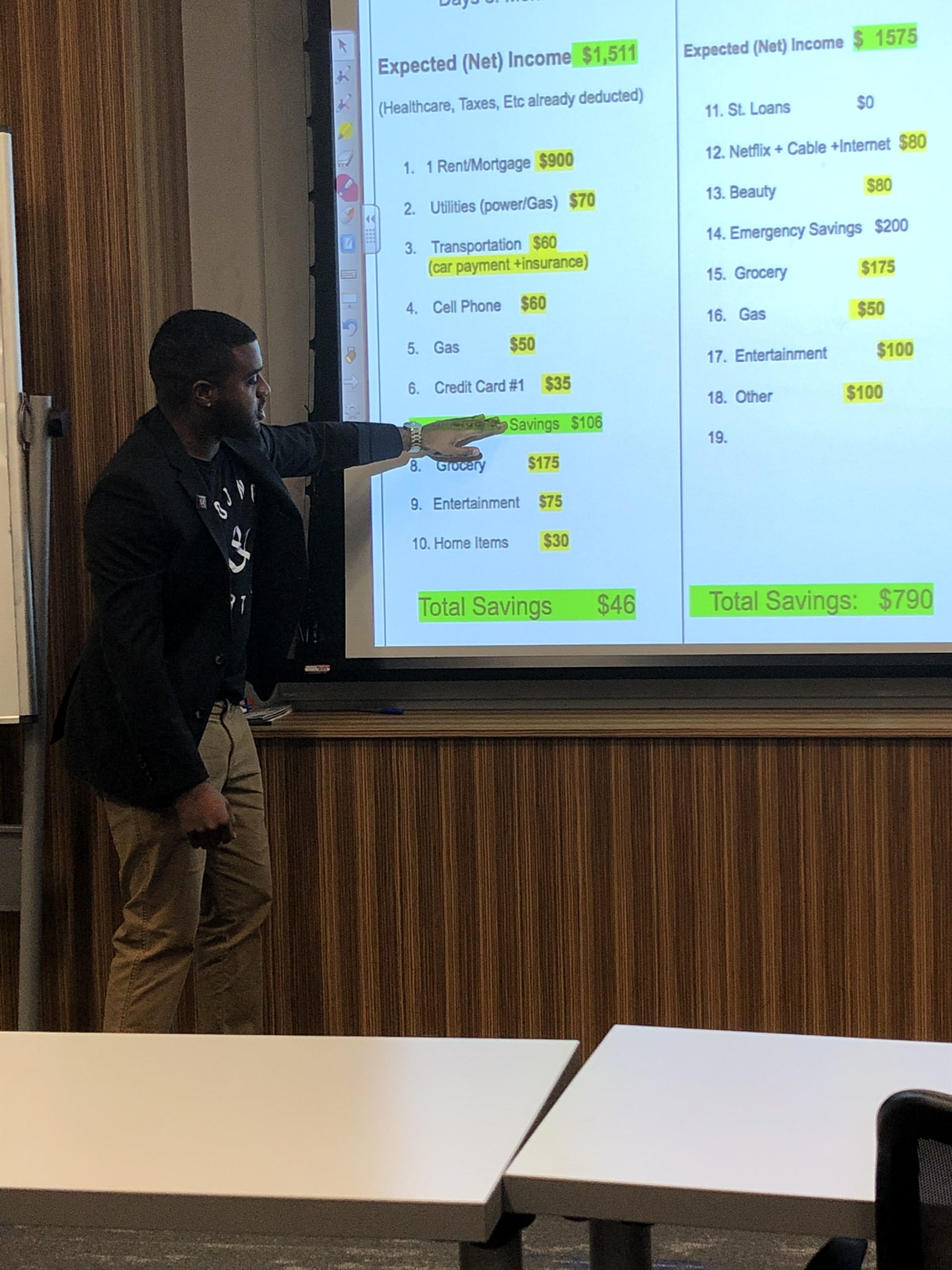

Debts can be a significant part of a budget, and managing them effectively is crucial for financial stability. Here are 10 examples of debts that individuals may include in their budget: Mortgage: Monthly payments for a home loan, typically a significant long-term...

by bridgesm06@gmail.com | Jan 7, 2024 | Budgeting & Debt Payoff, Money Mindset

Impulsive Spender: This type of spender tends to make unplanned purchases on a whim. Impulsive spenders may be drawn to sales, promotions, or the excitement of shopping without necessarily considering the long-term impact on their budget. Frugal Saver: The...

by bridgesm06@gmail.com | Jan 6, 2024 | Budgeting & Debt Payoff, Student Loan Repayment Plans

Federal Student Loan Forgiveness Programs Please click the graphic below to visit the federal student loan forgiveness programs update

by bridgesm06@gmail.com | Jan 5, 2024 | Budgeting & Debt Payoff, Student Loan Repayment Plans

Federal Student Loan Income Driven Repayment Programs Please visit studentaid.gov for all new 2024 updates on Student Loan Income Driven Repayment Programs. Please click the graphic below to visit studentaid.gov. ...

by bridgesm06@gmail.com | Jan 5, 2024 | Budgeting & Debt Payoff, Student Loan Repayment Plans

Student loan deferment and forbearance are both options that allow borrowers to temporarily postpone or reduce their federal student loan payments under specific circumstances. It’s important to note that these options are typically available for federal student...

by bridgesm06@gmail.com | Jan 5, 2024 | Budgeting & Debt Payoff

A credit balance transfer is a financial strategy in which a person moves the outstanding balance from one credit card to another. This is usually done to take advantage of a lower interest rate on the new credit card or to consolidate multiple debts into a single...