by bridgesm06@gmail.com | Jan 5, 2024 | Budgeting & Debt Payoff

The debt snowball method is a debt repayment strategy popularized by personal finance expert Dave Ramsey. It is a systematic approach to paying off multiple debts by focusing on clearing them one at a time, starting with the smallest balance first. The method is named...

by The Peblicite Firm | Oct 11, 2023 | Apps, Blog, Budgeting & Debt Payoff

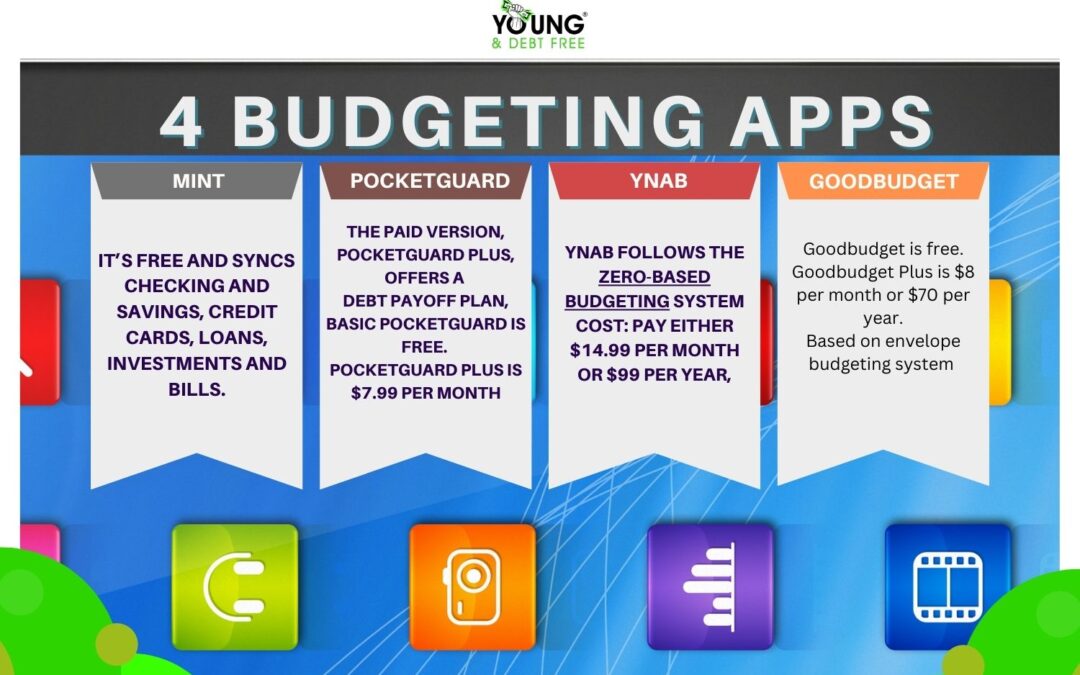

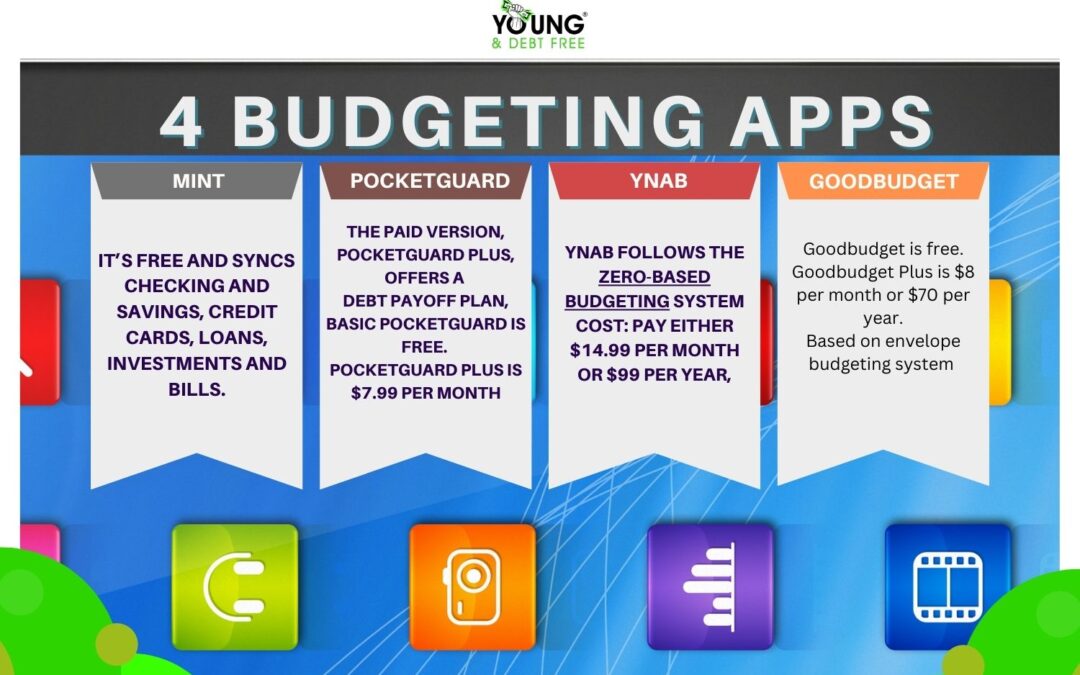

There are several easy-to-use budgeting apps available that can help you manage your finances effectively. Here are four popular ones: Mint: Mint is a free budgeting app that allows you to track your spending, create budgets, and set financial goals. It automatically...

by The Peblicite Firm | Oct 3, 2023 | Blog, Budgeting & Debt Payoff

Asking your employer about tuition assistance or other benefits is a common and important inquiry. Here’s a polite and professional way to approach the conversation: 1. Schedule a Meeting: Request a meeting with your supervisor or HR representative. This shows...

by The Peblicite Firm | Oct 3, 2023 | Blog, Budgeting & Debt Payoff

As of my September 2021, many employers offered tuition assistance programs to help their employees further their education. However, it’s essential to note that these programs can change, and the availability of tuition assistance might vary based on the...

by The Peblicite Firm | Oct 3, 2023 | Blog, Budgeting & Debt Payoff

Automation And Cash Flow Objective: Set up automatic billing and deposits from your job. Income- Ask your employer to divide your paychecks between your two checking accounts. Recall, checking # 1 will host majority of your income. While checking #2 will be a...

by The Peblicite Firm | Oct 3, 2023 | Blog, Budgeting & Debt Payoff

Your 5 Expense Accounts Checking Checking Account # 1 is for bills only. This account will pay all bills exclusively. Checking #1 will primarily serve the fixed and variable expenses category of your budget. Checking #2 – is for fun only. Deposit cash into this...