by bridgesm06@gmail.com | Jan 5, 2024 | Credit, Student Loan Repayment Plans

Credit Score and History: Before applying for a credit card, it’s essential to know your credit score. A higher credit score increases your chances of approval for better credit cards with favorable terms. Reviewing your credit history can also help you...

by bridgesm06@gmail.com | Jan 5, 2024 | Credit, Student Loan Repayment Plans

A credit report is a detailed record of an individual’s credit history and financial behavior. The information in a credit report is compiled by credit reporting agencies, also known as credit bureaus. The components of a credit report typically include:...

by bridgesm06@gmail.com | Jan 5, 2024 | Credit, Student Loan Repayment Plans

The three major credit bureaus in the United States are: Equifax: Website: Equifax Phone: 1-866-349-5191 Experian: Website: Experian Phone: 1-888-397-3742 TransUnion: Website: TransUnion Phone: 1-800-916-8800 These credit reporting agencies collect and maintain...

by bridgesm06@gmail.com | Jan 4, 2024 | Credit, Student Loan Repayment Plans

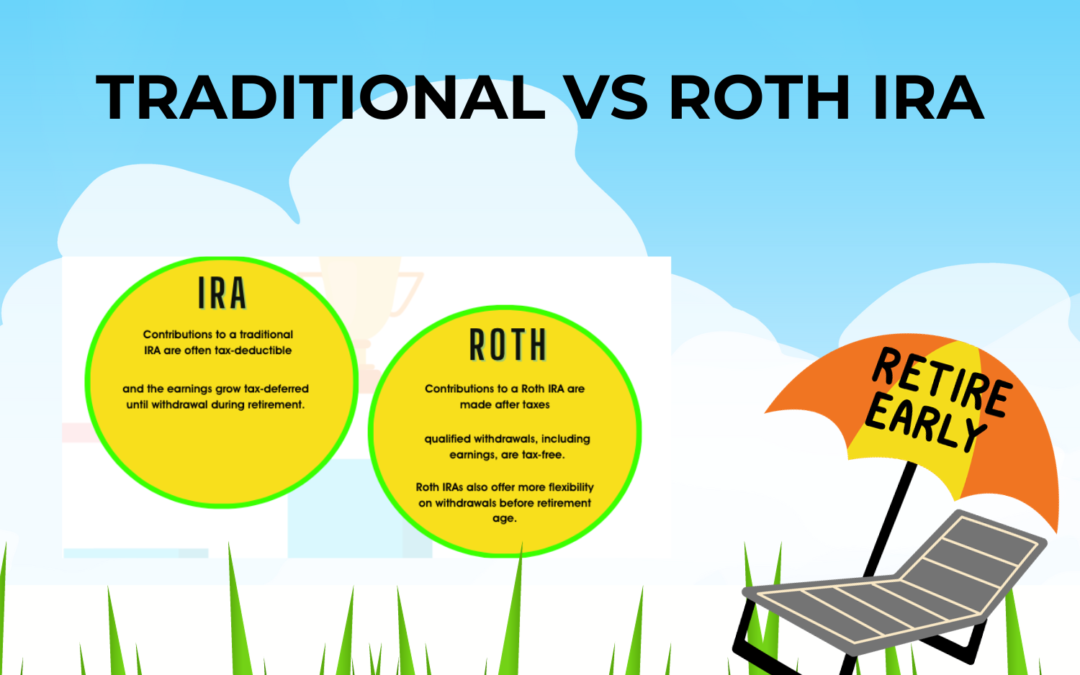

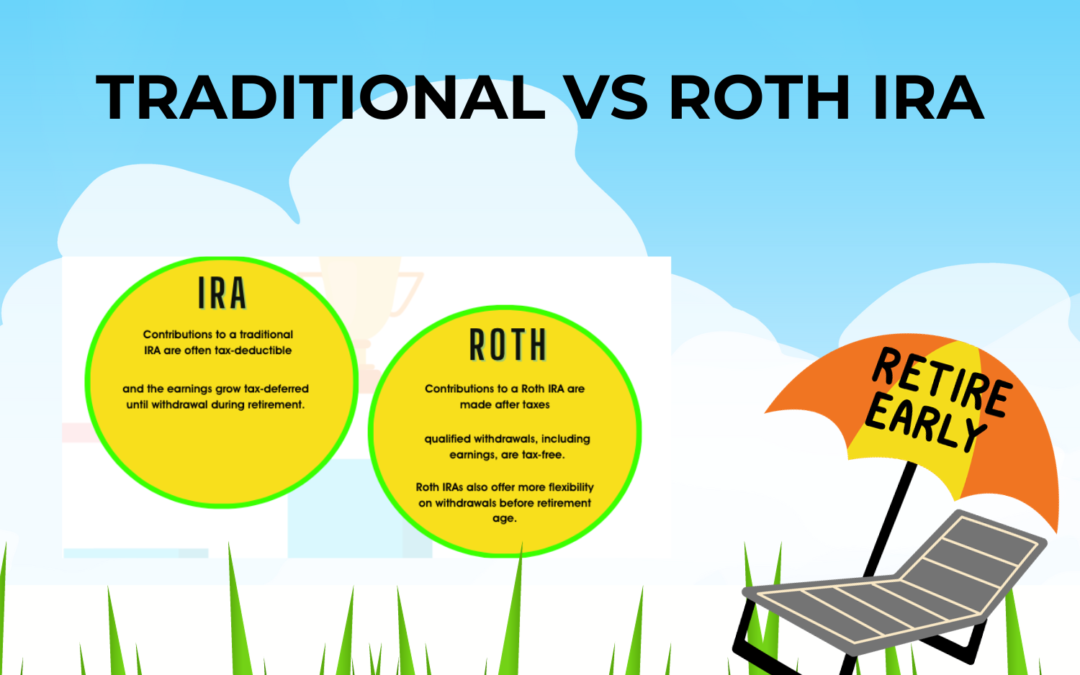

The choice between a Roth IRA and a Traditional IRA depends on your individual financial situation, goals, and tax considerations. Here are the key differences between Roth and Traditional IRAs: Traditional IRA: Tax Deductibility: Tax Deductible Contributions:...

by bridgesm06@gmail.com | Jan 4, 2024 | Credit, Student Loan Repayment Plans

There are several types of retirement accounts available in the United States, each with its own unique tax advantages and eligibility requirements. Here are examples of four different types of retirement accounts you can consider investing in: 401(k) Plan: A...

by The Peblicite Firm | Oct 11, 2023 | Credit, Student Loan Repayment Plans

A high yield savings account is a type of savings account that offers a higher interest rate compared to a regular savings account. The higher interest rate allows your money to grow at a faster pace, making it an attractive option for individuals looking to earn more...