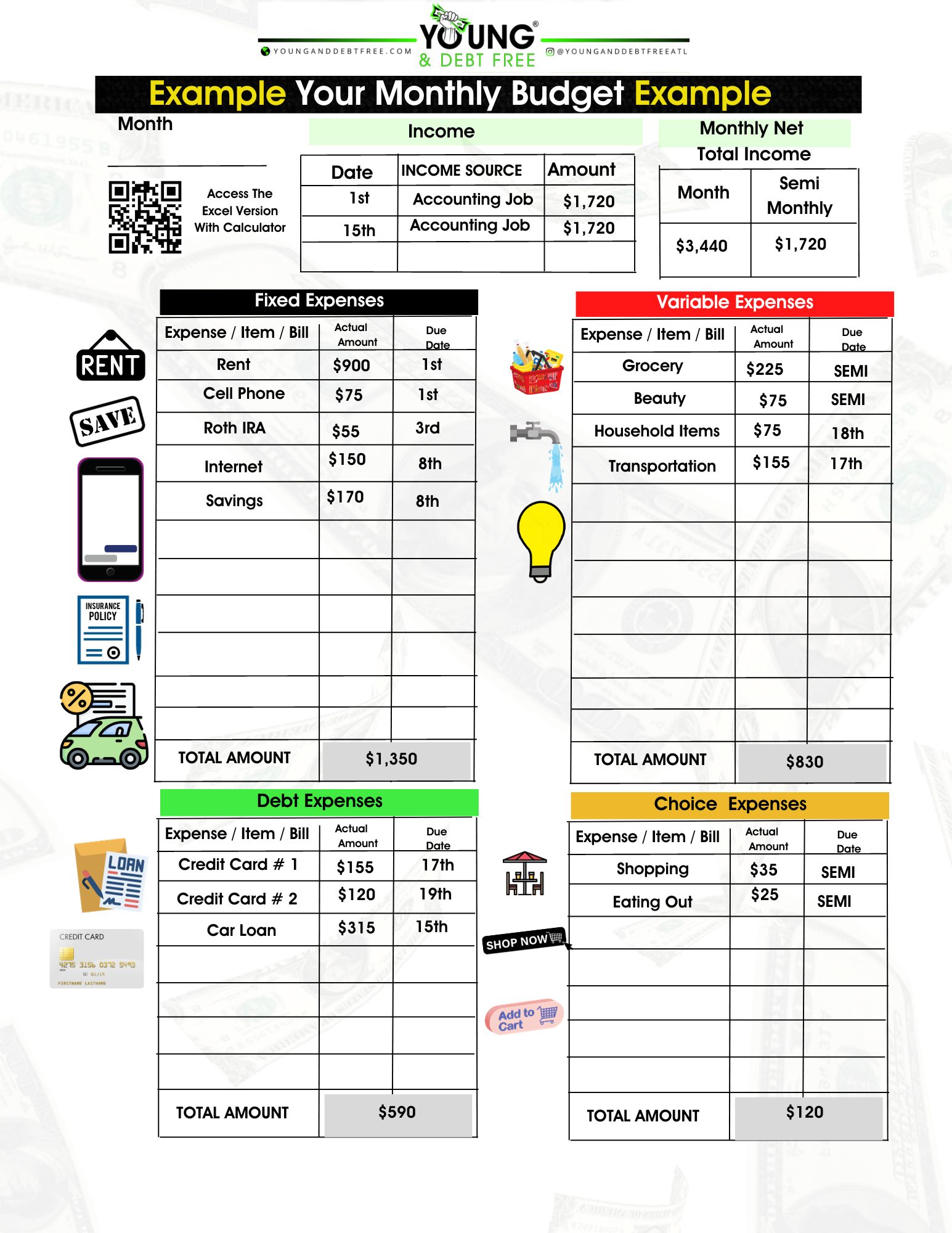

Objective: Based on your current income and the amounts you calculated in previous activities, determine how much it costs you to live each month and semi-monthly

- You will need the total amount of your minimum debt payments, fixed expenses, choice expenses, variable expenses, minimum savings and income.

- Please fill in the worksheet on the next page with all itemized expenses in each category. Be specific. Be Intentional. Do not omit any expenses.

Why is this important?

- This is your budget. This is an accurate picture of your financial life.

- You will be able to see how much you are spending in specific categories. You will also be able to identify what part of the month you spend the most on bills. For example, most people spend more at the beginning of the month due to mortgage and rent payments.

Next:

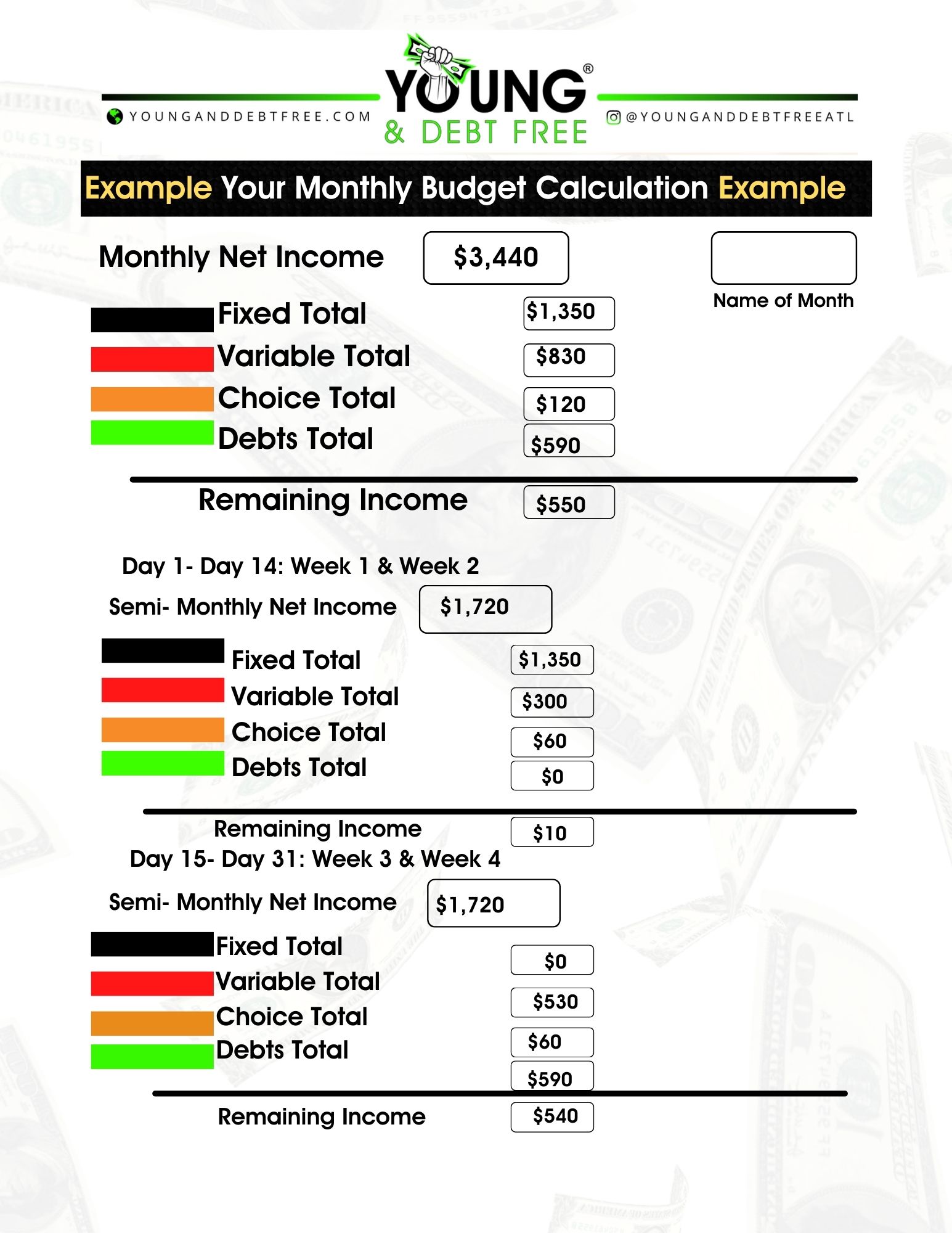

After this activity, determine how much money you have remaining at the end of each pay period

MJ’s Reflection:

- This activity helped when I started to strategize my debt free pay off plan. I used the remaining income for debt payments and requested new due dates for certain bills. For example, I moved a payment due date from the 4th to the 19th due to higher expenses at the beginning of the month.