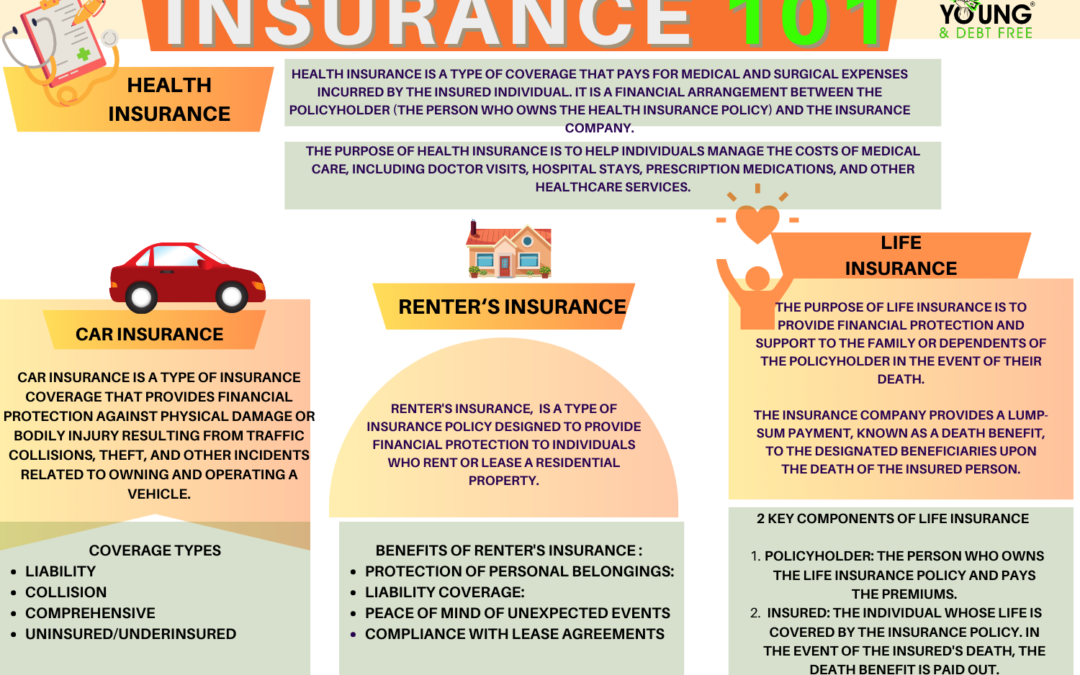

Car insurance is a type of insurance coverage that provides financial protection against physical damage or bodily injury resulting from traffic collisions, theft, and other incidents related to owning and operating a vehicle. It is a contractual agreement between the policyholder (the person who owns the insurance policy) and an insurance company.

Key components of car insurance include:

- Policyholder: The person who owns the car insurance policy and is responsible for paying premiums to maintain coverage.

- Premium: The amount paid by the policyholder to the insurance company to maintain car insurance coverage. Premiums can be paid monthly, quarterly, or annually.

- Deductible: The amount the policyholder is responsible for paying out of pocket before the insurance company covers the remaining cost of a covered claim. For example, if a policyholder has a $500 deductible and files a claim for $2,000 in damages, the policyholder pays $500, and the insurance company covers the remaining $1,500.

- Coverage Types:

- Liability Coverage: Pays for bodily injury and property damage that the insured is legally responsible for in an accident. It typically includes coverage for medical expenses and property damage to others.

- Collision Coverage: Covers damage to the insured vehicle resulting from a collision with another object or vehicle.

- Comprehensive Coverage: Protects against damage to the insured vehicle that is not caused by a collision, such as theft, vandalism, natural disasters, or hitting an animal.

- Uninsured/Underinsured Motorist Coverage: Provides coverage if the insured is involved in an accident with a driver who does not have insurance or has insufficient coverage.

- Policy Limits: The maximum amount the insurance company will pay for covered claims under specific types of coverage.

- Exclusions: Specific events or circumstances that are not covered by the insurance policy. Policyholders should be aware of these exclusions and understand what is and isn’t covered.

- Endorsements: Additional coverage options that policyholders can add to their insurance policies for extra protection. Examples include rental car coverage, roadside assistance, or coverage for custom parts and equipment.

Car insurance is a legal requirement in many places, and the specific coverage requirements can vary by jurisdiction. The purpose of car insurance is to provide financial protection to drivers, passengers, and third parties in the event of accidents or other covered incidents. It helps cover the costs of repairing or replacing vehicles, medical expenses, and legal liabilities associated with accidents. It’s important for individuals to carefully review and understand the terms of their car insurance policies to ensure they have the coverage they need.