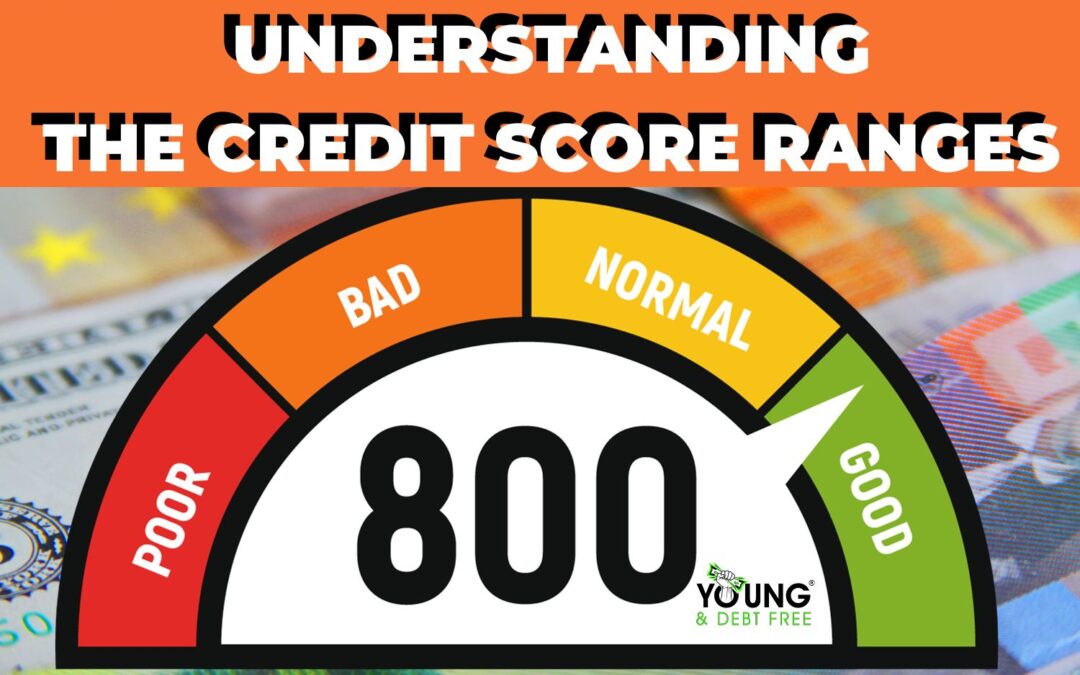

FICO scores range from 300 to 850. Here’s a breakdown of the credit score ranges according to FICO:

- 300 – 579: Poor. Individuals in this range are considered high-risk borrowers. It can be difficult to obtain credit or loans, and if approved, the interest rates are likely to be very high.

- 580 – 669: Fair. While this range is better than poor, individuals may still face challenges in obtaining credit, and if approved, interest rates will be higher than average.

- 670 – 739: Good. Borrowers in this range are considered less risky to lenders. They are more likely to be approved for credit and may qualify for relatively competitive interest rates.

- 740 – 799: Very Good. Individuals with scores in this range have a strong credit history and are likely to be approved for credit with favorable terms and interest rates.

- 800 – 850: Excellent. Borrowers in this range have exceptional creditworthiness. They are very likely to be approved for credit and will qualify for the best possible interest rates and terms.

Remember, these ranges can vary slightly depending on the lender and the specific credit scoring model they use. Generally, the higher your credit score, the better your financial opportunities, including lower interest rates on loans and credit cards.