by bridgesm06@gmail.com | Jan 4, 2024 | Credit, Student Loan Repayment Plans

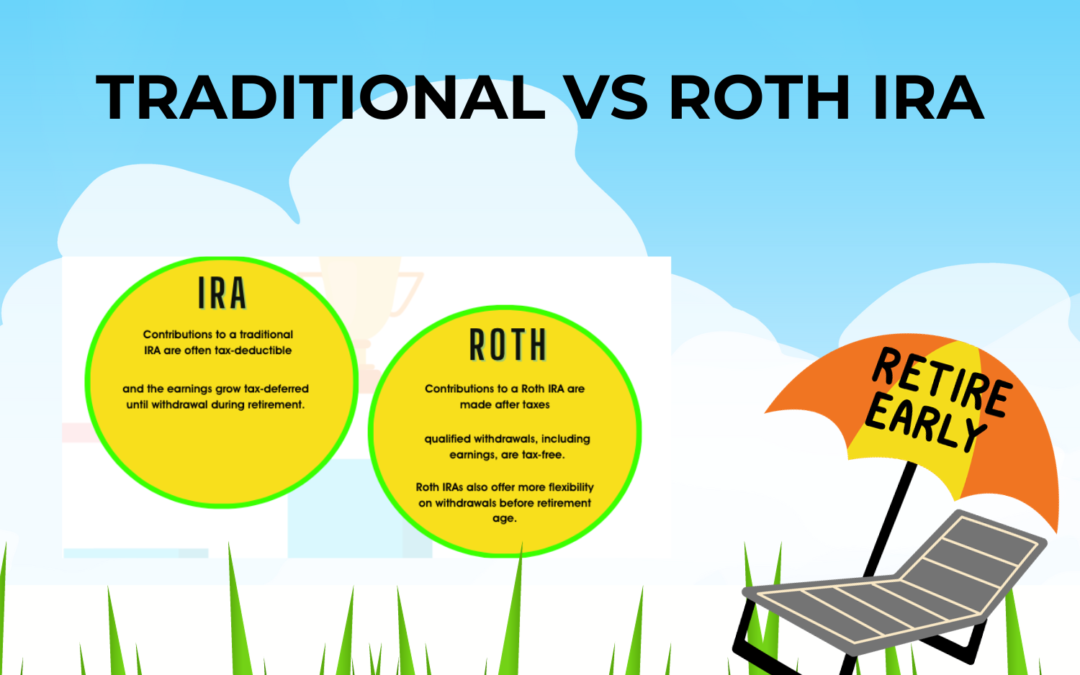

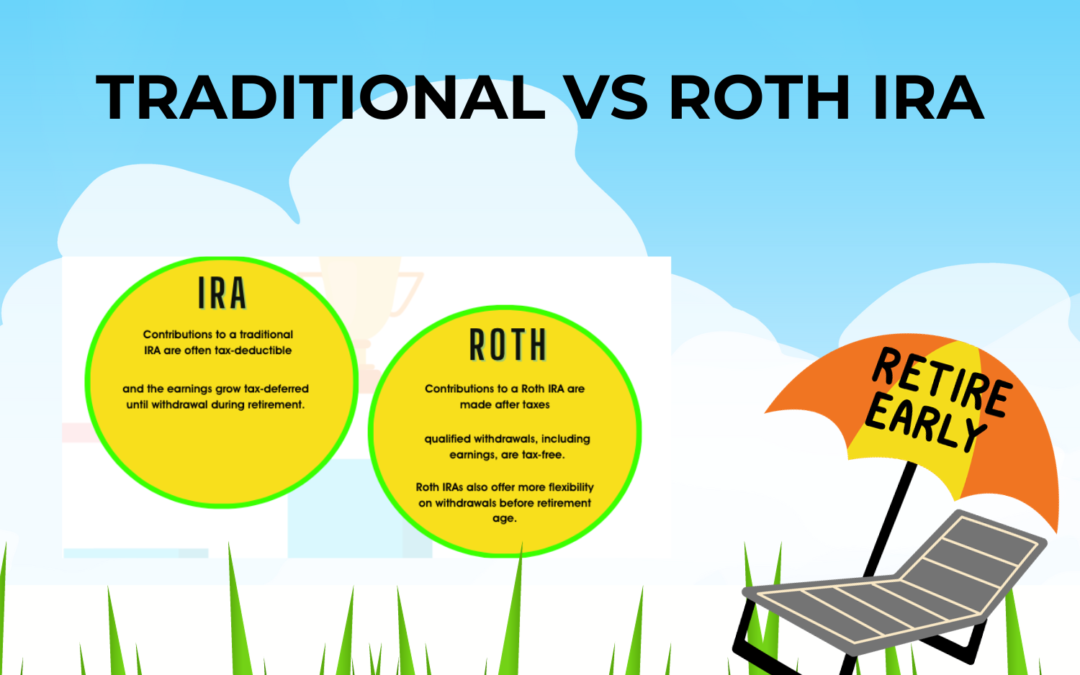

The choice between a Roth IRA and a Traditional IRA depends on your individual financial situation, goals, and tax considerations. Here are the key differences between Roth and Traditional IRAs: Traditional IRA: Tax Deductibility: Tax Deductible Contributions:...

by bridgesm06@gmail.com | Jan 4, 2024 | Credit, Student Loan Repayment Plans

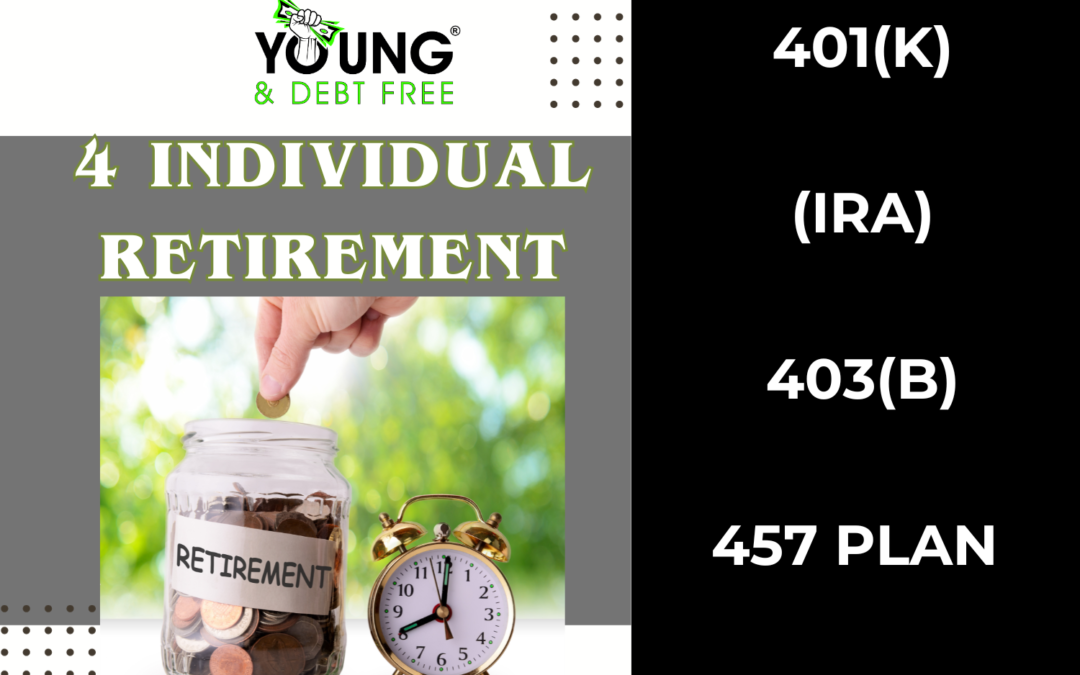

There are several types of retirement accounts available in the United States, each with its own unique tax advantages and eligibility requirements. Here are examples of four different types of retirement accounts you can consider investing in: 401(k) Plan: A...

by The Peblicite Firm | Oct 11, 2023 | Credit, Student Loan Repayment Plans

A high yield savings account is a type of savings account that offers a higher interest rate compared to a regular savings account. The higher interest rate allows your money to grow at a faster pace, making it an attractive option for individuals looking to earn more...

by The Peblicite Firm | Oct 11, 2023 | Credit, Student Loan Repayment Plans

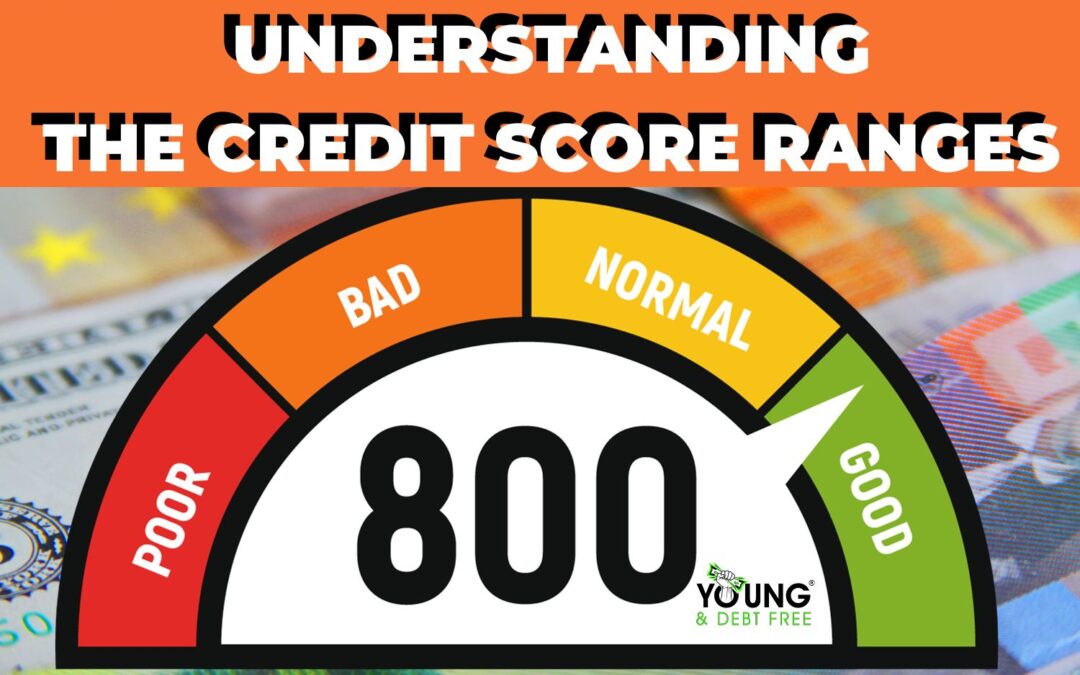

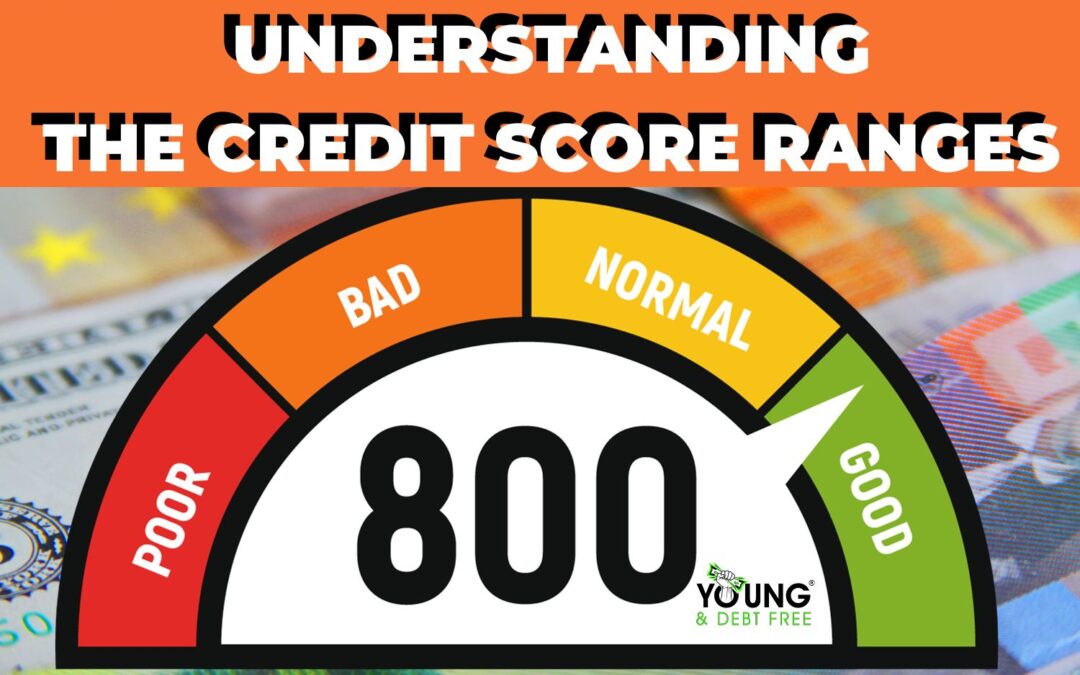

FICO scores range from 300 to 850. Here’s a breakdown of the credit score ranges according to FICO: 300 – 579: Poor. Individuals in this range are considered high-risk borrowers. It can be difficult to obtain credit or loans, and if approved, the interest...

by The Peblicite Firm | Oct 11, 2023 | Credit, Student Loan Repayment Plans

FICO scores, which are commonly used by lenders to assess an individual’s credit risk, are based on several factors. The FICO score is calculated using the following components: Payment History (35%): This is the most significant factor in your FICO score. It...

by The Peblicite Firm | Oct 11, 2023 | Student Loan Repayment Plans

it’s crucial to check the official Federal Student Aid website or contact your loan servicer for the most current information. As of 2021, here are the main federal student loan repayment plans: Standard Repayment Plan: This is the default repayment plan. You...